In the heavily regulated industry of financial services, it took a little longer for financial advisors to regularly use social media but they’re now flocking to it to communicate sales messaging. It is no longer a question of whether a financial advisor uses social media, but rather how they make use of it, according to the sixth edition of the Putnam Investments Social Advisor Study.

Nearly all U.S. financial advisors (98%) are using social media for business and/or personal use at this point, with 83% using it for business purposes.

The sixth edition of the Putnam Investments Social Advisor Study was released today. (Graphic: Business Wire)

Additionally, the advisor community self-reports a high level of proficiency when it comes to their social media capabilities, with 61% now describing their skill level as “expert,” up from 46% last year.

“The use of social media for business purposes by financial advisors has matured during the six years we have conducted this study, evolving from the periphery of the advisor experience into a critical tool for business development and client service,” said Mark McKenna, Head of Global Marketing, Putnam Investments. “We are fully committed to helping advisors use social media as an indispensable piece of their practice management, both to build their businesses and to deepen their relationships with clients.”

Among advisors not currently using social media for business, 28% said they were “absolutely certain” that they would start using it for business in the next three years, up from just 9% last year. “Clearly, we have not yet reached a saturation point,” noted McKenna.

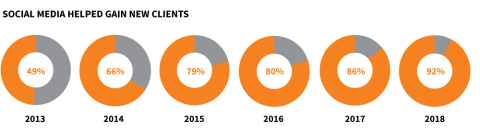

Advisors report using their social media expertise to make initial contact with referrals from existing clients (57% compared with 52% last year*), acquire new clients (92% versus 86% last year**) and increase assets under management (the average AUM increase from social media initiatives is $4.9 million, including $1.4 million in the past 12 months*).

Putnam’s survey of 1,021 financial advisors across the United States also found that almost half of advisors (48%*) strongly agree that social media has changed the nature of their relationship with their clients, up from 39% last year. Of those who agree social media has changed the nature of their client relationships:

- More than two-thirds (67%) say they have more frequent communication with clients as a result of social media; yet 44% note that they connect with their clients less often by phone or in person than before;

- Seven in 10 (70%) say it is easier to share information with their clients; and,

- Fifty-seven percent say decision-making is faster and easier.

Social Media Networks: LinkedIn Still Dominant, but Other Platforms In Play

According to the study, in terms of use for business purposes, LinkedIn continues to be the platform of choice for advisors where they follow companies, comment on or share others’ updates, request recommendations and post to groups or pages. Advisors also are increasing their use of LinkedIn for business development: connecting with other financial professionals, enhancing current client relationships, cultivating prospective clients and expanding their professional knowledge.

“Each of the major social media networks is preferred for different reasons, with LinkedIn favored for improving referral networks, Facebook for enhancing current client relationships and Twitter for business development initiatives such as thought leadership,” said McKenna. “Additionally, advisors are increasing their use of YouTube, Instagram and Snapchat, often using them at rates approaching those of the more established social networks.”

Overall, business use of key social platforms by advisors stacks up as follows: LinkedIn (72%), Facebook (62%), Twitter (52%), YouTube (41%), Instagram (38%), and Snapchat (22%).

Putnam’s research also provided a profile of advisors gaining the most assets from social media use, relative to their total AUM. Of the 14% of advisors whose assets gained through social media represent 10% or more of their total AUM:

- Close to half (46%) are between the ages of 30 and 39 (versus 35% of all advisors in the study);

- Their average AUM gained through social media is three times the average for all advisors in the study ($15.3 million versus $4.9 million overall);

- Nearly six in 10 (58%) say social media plays a very significant role in their practice (compared with 47% of all advisors in the study);

- They are more likely to pay for enhanced services from LinkedIn (80% versus 62% overall);

- They are more likely to have been trained on social media by a colleague from their firms or offices (50% versus 39% overall) or by a wholesaler or representative from an investment partner firm (42% versus 37% overall); and,

- Their next step to growing social media is to integrate the data into their CRM system (57% versus 45% overall).

If you’re a financial advisor or insurance professional looking for compliant online advertising, direct mail, or social media strategies for your business, talk with the FunnelGrowth team!

This is author biographical info, that can be used to tell more about you, your iterests, background and experience. You can change it on Admin > Users > Your Profile > Biographical Info page."

About FunnelGrowth

We are a digital marketing company with a focus on helping our customers achieve increase their sales across all online channels.

Request a free quote

Is your company's marketing not getting the results you need or you need help executing a new campaign? Contact us to schedule a FREE 30 minute strategy session.

Recent Posts

- The Importance Of Good Web Hosting September 17, 2019

- Why You Need Google Reviews For Your Local Business September 3, 2019

- Making A Content Strategy For Your Business August 20, 2019